Adding tax ensures you comply with local laws and charge your customers correctly for products or services. Tax settings are versatile and can be applied across various pages where pricing is displayed, including E-commerce, Events, Pricing Tables, and Schedule Booking.

While you can access specific page settings, general tax configuration is managed through the central dashboard:

Go to your Dashboard.

Click Settings and select Tax from the menu.

Click Add New Region to define where your tax rules apply.

Defining Areas – Enter a Custom Region Name (e.g., "European Union" or "North America") and select the countries included.

Granular Control – For countries like the US, UK, or Japan, you can select specific states or regions to apply localized rates.

Flexible Rates – You can apply a uniform tax rate to an entire region or set different rates for individual countries and states within that region.

Shipping & Tax – You can toggle whether tax should be calculated after the shipping cost is added to the subtotal.

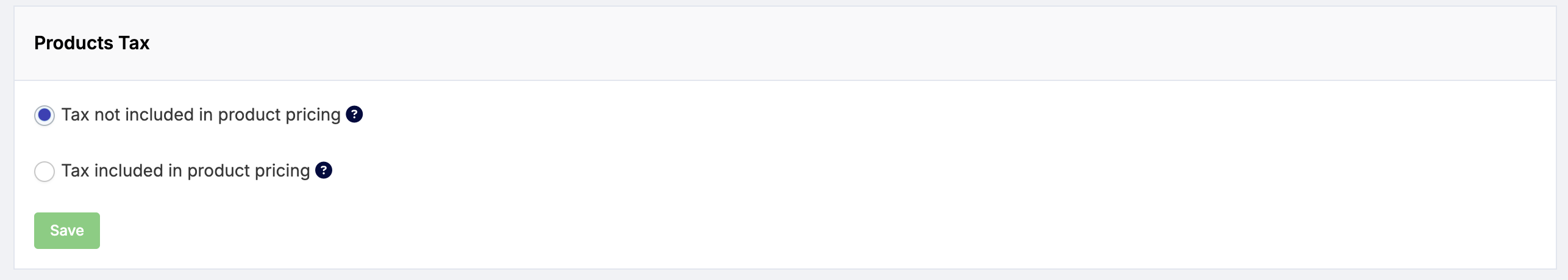

Product Pricing – Under the Products Tax section, choose whether your displayed prices already include tax or if tax should be added at checkout.

Non-Taxable Items – You can mark specific products as "tax-free" if they are exempt from taxation in certain jurisdictions.

Broad Application – Tax settings configured here will automatically apply to any relevant transaction pages, such as your Schedule Booking or Events tickets.

Legal Compliance – Always verify current tax rates for your specific region to ensure you are collecting the correct amount for your business's legal standing.

Visibility – If your prices are set to "Tax Included," your customers will see the final price upfront, while "Tax Not Included" will show the tax breakdown during the final payment step.